Case Summary: Akoustis Technologies Chapter 11

Akoustis Technologies has filed for Chapter 11 bankruptcy following $59M legal judgment, aiming to facilitate a strategic asset sale.

Business Description

Headquartered in Huntersville, NC, Akoustis Technologies, Inc. (“Akoustis” or the “Company”) operates as a holding company for its wholly owned subsidiary, Akoustis, Inc. (“OpCo”), which, in turn, wholly owns RFM Integrated Device, Inc. (“RFMI”) and Grinding and Dicing Services, Inc. (“GDSI”) (collectively, the “Operating Subsidiaries”).

Akoustis specializes in developing, designing, and manufacturing innovative radio frequency (RF) filter solutions for the wireless industry, catering to products such as smartphones, tablets, network infrastructure equipment, WiFi Customer Premise Equipment, and defense applications.

- These RF filters play a critical role in signal selection and rejection, enabling enhanced functionality in the RF front-end of devices.

The Company’s common stock is publicly traded on Nasdaq under the symbol “AKTS.”

As of the Petition Date, the Company reported assets totaling $50-$100 million and liabilities totaling $100-$500 million.

Corporate History

Akoustis Technologies, Inc. was incorporated on April 10, 2013, and reincorporated in Delaware on December 15, 2016.

The Company has focused on developing wireless filter technology and, more recently, manufacturing and selling products incorporating this technology.

- Research and development expenditures totaled $30.0 million and $33.2 million for fiscal years ending in June 2024 and June 2023, respectively.

Key milestones include:

- The acquisition of RFMI, completed in April 2023, expanded the product portfolio to include surface acoustic wave resonators and RF filters, among others.

- The acquisition of GDSI added advanced back-end semiconductor processing and supply chain services.

The Company faced compliance challenges with Nasdaq listing rules, receiving notifications in August and October 2024 for stock price and equity deficiencies.

- Following an October 8, 2024, hearing, Nasdaq granted the Company continued listing, subject to certain conditions.

RFMI provides components and services to markets such as automotive and industrial applications, while GDSI supports over 250 customers across sectors including automotive, defense, and communications.

Operations Overview

Akoustis develops, designs, and manufactures RF filter solutions targeting performance issues in RF front-end devices, addressing frequency band complexities, loss, and bandwidth limitations.

- Product offerings include single-band and multi-band filter designs for 5G and WiFi (5 GHz and 6 GHz) bands.

Manufacturing is centralized in a 125,000 square-foot wafer facility in Canandaigua, New York.

Recent operational expansions:

- Through RFMI, the Company offers surface acoustic wave resonators, RF filters, crystal resonators, and oscillators, addressing markets such as automotive and industrial applications.

- GDSI provides semiconductor processing services including wafer thinning, polishing, stealth dicing, and automated inspection, supporting a diverse client base across industries.

The Company leverages its manufacturing and technological capabilities to address high-performance demands in wireless and industrial markets.

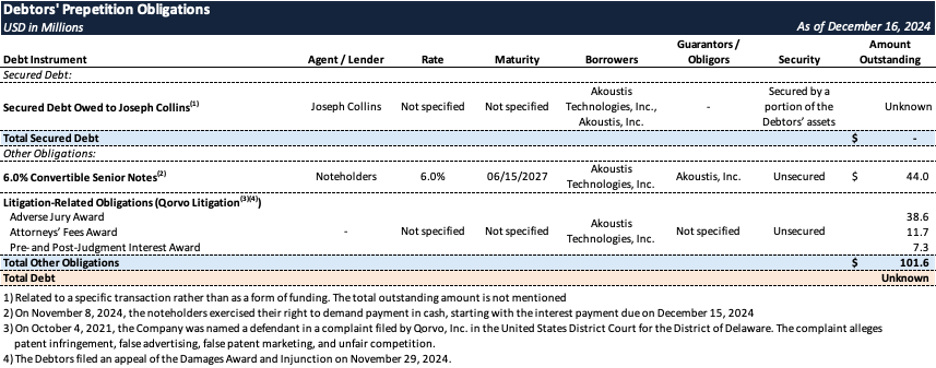

Prepetition Capital Structure

As of the Petition Date, the Company has no traditional secured debt for working capital, relying instead on equity sales and convertible note offerings for funding.

- Primary liabilities include convertible notes, general operating expenditures, and pending litigation with Qorvo, Inc., which have placed significant strain on the Company’s liquidity.

- The Debtors also hold limited secured debt in favor of Joseph Collins.

- This debt pertains to specific transaction payment obligations, not as funding.

- It is secured by a portion of the Debtors’ assets.

Recent financing activities include a May 24, 2024, direct offering of 10,500,000 shares of common stock and pre-funded warrants for 39,500,000 shares, raising approximately $9.2 million in net proceeds.

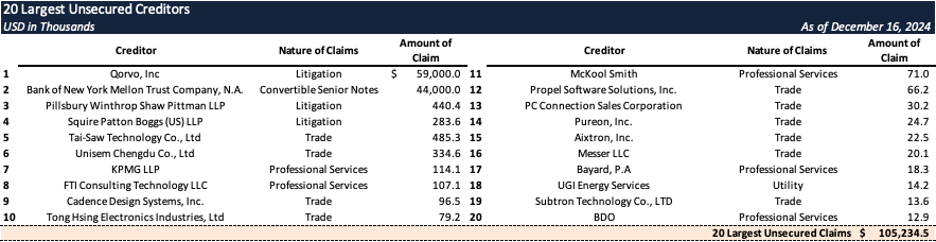

Additionally, on June 9, 2022, the Company issued $44.0 million in 6.0% Convertible Senior Notes due 2027, guaranteed by Akoustis, Inc., with semi-annual interest payments that may be made in cash or common stock.

Top Unsecured Claims

Events Leading to Bankruptcy

Qorvo Litigation and Damages Award

- Litigation and Verdict:

- Qorvo, Inc. initiated litigation on October 4, 2021, alleging patent infringement, trade secret misappropriation, false advertising, and unfair competition.

- On May 17, 2024, a jury awarded $38.6 million in damages against the Debtors, followed by additional judgments for attorneys’ fees and interest.

- The total Damages Award entered on November 22, 2024, significantly exceeded the Debtors’ liquidity, critically undermining operations.

- Impact on Financial Position:

- As of June 30, 2024, the Debtors had $36.8 million in current assets, including $24.4 million in cash on hand.

- The judgment and associated costs far outstripped available resources, eroding the ability to operate as a going concern.

Injunction and Compliance Efforts

- Court-Imposed Injunction:

- The District Court issued a permanent injunction barring the use of Qorvo’s trade secrets and the sale of infringing products.

- Compliance required extensive file reviews and purges, monitored by Qorvo’s audit rights.

- Appeals and Mitigation Steps:

- The Debtors appealed the Damages Award and Injunction on November 29, 2024.

- Engaged a third-party vendor to oversee compliance while preserving operational assets and preparing for a sale process.

Liquidity Measures and the Last Time Buy Agreement

- Liquidity Boost via Agreement:

- Entered a Last Time Buy Agreement on June 14, 2024, with a key customer to produce 14 million radio frequency filters.

- Secured $8 million in advance payments to support operations and evaluate strategic alternatives.

- Progress and Revenue Outlook:

- Delivered sufficient products by December 13, 2024, enabling the customer to release liens on the Debtors’ equipment.

- Expected to generate an additional $12 million in revenue, contingent on maintaining operational stability.

Employee Attrition and Operational Challenges

- Workforce Reductions:

- Litigation fallout reduced headcount from over 200 to approximately 110 within a year, including key executives.

- Strained operations and created instability during a critical period.

- Stabilization Efforts:

- Introduced a revised compensation structure tied to production milestones under the Last Time Buy Agreement.

- Successfully retained key personnel and ensured operational continuity.

Strategic Options and Decision to Commence Chapter 11

- Restructuring Exploration:

- Assessed joint ventures, settlements with Qorvo, and other strategic initiatives.

- Financial constraints, compliance obligations, and operational challenges limited viable alternatives.

- Chapter 11 Decision:

- The Debtors concluded that Chapter 11 provides the necessary breathing room to market and sell substantially all assets, maximizing recovery for creditors.

- A $7 million bid ($10 million if closed within 52 days) from Gordon Brothers will anchor the auction, with closing targeted for April 2025.