Case Summary: CCA Construction Chapter 11

CCA Construction, a subsidiary of China State Construction Engineering, has filed for Chapter 11 following a $1.64 billion judgment.

Business Description

Headquartered in Morristown, NJ, CCA Construction (“CCA” or the “Debtor”), along with its non-Debtor subsidiaries (the “Non-Debtor Subsidiaries,” and together with CCA, the “Company”), provides construction and project management services across various sectors, including civil, commercial, residential, and public buildings.

- CCA operates as an indirect subsidiary of China State Construction Engineering Corp. Ltd. (“CSCEC”), a publicly traded company on the Shanghai Stock Exchange and one of the world’s largest investment and construction firms.

- The Company’s business activities are concentrated in the New York and New Jersey metropolitan area, Washington, D.C., the Carolinas, and Texas.

CCA provides shared services support, including communications, accounting, IT, human resources, insurance, legal, and general administrative services, to its Non-Debtor Subsidiaries through a cost allocation model (the “Shared Services Program”).

- The Shared Services Program allows for reimbursement of costs by affiliates and periodic adjustments to cost allocations.

- Additionally, CCA charges affiliates for specific expenses incurred on their behalf.

- These shared services generate cost savings and synergies, benefiting the Non-Debtor Subsidiaries by reducing operational expenses and improving cash flow, ultimately to the advantage of CCA as their sole owner.

As of the Petition Date, the Debtor reported $100-$500 million in assets and $1-$10 billion in liabilities.

Corporate Structure

CCA was established in 1993 as a Delaware corporation.

The Debtor’s primary assets consist of equity interests in the Non-Debtor Subsidiaries, which are not part of the Chapter 11 proceedings and continue to operate in the ordinary course of business. These subsidiaries include:

- Plaza Group Holdings LLC (“Plaza”): A Delaware entity providing construction management and general contracting for urban development projects.

- Established in 1986, Plaza operates nationally, with headquarters in New York and additional operations in New Jersey and Washington, D.C.

- Key projects include City Hall (Manhattan), Nassau University Medical Center, MTA Fulton Street Transit Station, Madison Square Park Tower, 99 Hudson Street (NJ’s tallest building), and One Thousand Museum (Miami).

- Currently focuses on office-to-residential conversions to meet housing demand.

- Plaza contributes the majority of CCA’s revenues since its acquisition in 2014.

- CCA Civil, Inc. (“Civil”): A Delaware corporation specializing in large-scale infrastructure construction and maintenance, such as transportation and utility projects.

- Integral to public infrastructure in the NY-NJ metro area for 19+ years.

- Major projects include the Pulaski Skyway, Long Island Expressway, I-278, Alexander Hamilton Bridge, and Route 7 Wittpenn Bridge (2023 ASCE NJ Project of the Year).

- China Construction America of South Carolina, Inc. (“CCASC”): Based in South Carolina, CCASC supports local communities in the Carolinas.

- Completed nearly 20 educational facilities (3M+ square feet), including Dreher High School, USC Honors Residence, and Trident Tech Nursing School, among others.

- Delivered key public facilities like Goose Creek Fire Station and JW Clay Parking Garage.

- Recently expanded into residential development projects.

- Strategic Capital (Beijing) Consulting Co., Ltd. (“SC Beijing”): A China-based entity providing administrative services to CCA.

- Provides employee insurance programs and supports CCA’s Shared Services Program.

Operations Overview

Since its establishment, CCA has directed its subsidiaries in executing significant large-scale construction and project management services, particularly in the New York and New Jersey metropolitan area.

- Leadership at CCA has included contributions from seasoned executives with extensive experience in both CCA and its parent company, CSCEC.

CCA employs 39 full-time staff to manage its operations and provide shared services.

Non-Debtor Subsidiaries employ 91 full-time staff responsible for managing critical construction and development projects across the U.S.

Shared Services Program

- The Shared Services Program is a critical operational component for CCA and its affiliates, centralizing essential support functions such as communications, accounting, IT, insurance, HR, legal, and general administration.

- The program enables economies of scale, reducing overhead and improving cash flow across affiliates by centralizing services and aggregating procurement.

- CCA is generally entitled to reimbursement for its costs from the participating affiliates under an allocation mechanism based upon whether such costs are directly or indirectly incurred by CCA.

- Direct Costs (e.g., project-specific expenses like IT services or safety programs) are allocated based on usage or revenue.

- Indirect Costs (e.g., tax preparation, audit expenses) are allocated at year-end using metrics like headcount or departmental effort.

- CCA rigorously tracks all intercompany transactions and has implemented enhanced mechanisms to ensure transparency during the Chapter 11 process.

- CCA also relies on services from SC Beijing to meet insurance and regulatory needs in China. These costs are allocated based on actual affiliate usage.

Prepetition Obligations

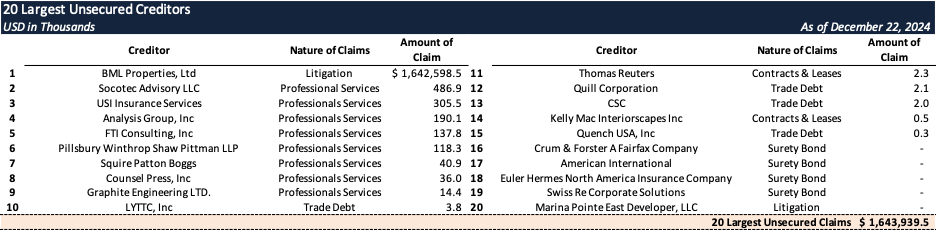

Top Unsecured Claims

Events Leading to Bankruptcy

Business Challenges and Policy Headwinds

- Over the past decade, the Company experienced a sharp decline in new contract value and related revenues.

- A significant portion of the decline occurred in the past five years, driven by:

- A substantial reduction in construction contracts from Chinese companies operating in the United States, particularly in real estate development and manufacturing.

- A broader retreat of Chinese firms from the U.S. market due to:

- Shifts in geopolitical relations between China and the United States.

- Changes to China’s overseas direct investment policies enacted in 2017.

- The contraction in revenue base caused general and administrative expenses to grow disproportionately as a percentage of revenue, resulting in sustained negative cash flows.

Overview of Largest Claims Against CCA

- Baha Mar Judgment: The largest claim against CCA, as detailed below.

- Surety Bond Obligations:

- CCA is a guarantor for approximately $700 million in surety bond obligations related to construction projects managed by its Non-Debtor Subsidiaries.

- These obligations could crystallize into claims if subsidiaries fail to complete the projects or cover associated costs.

- Continued ordinary operations by the Non-Debtor Subsidiaries and Shared Services Program are critical to mitigating this risk.

- Intercompany Loans:

- As of the petition date, CCA owes approximately $124.8 million to its direct parent company CSCEC Holding Company, Inc., due to periodic loans.

Surety Coverage for Construction Operations

- Historically, the Non-Debtor Subsidiaries depended on substantial surety bond support to bid for and execute large-scale projects.

- An initial $2.5 billion surety bond provided by American International Group Inc. (“AIG”) enabled successful participation in high-value projects.

- AIG’s exit from the surety bond business in 2020 led to early termination of this capacity.

- Replacement coverage was secured only after a lapse and at a significantly reduced amount of $575 million, limiting project volume and revenue potential.

The Baha Mar Litigation

- In 2017, CCA became embroiled in litigation concerning the Baha Mar resort in The Bahamas, involving affiliates CCA Bahamas (“CCAB”) and CSCEC (Bahamas), Ltd. (“CSCECB,” and together with CCA and CCAB, the “Defendants”).

- The litigation, initiated by BML Properties Ltd. (“BMLP”), sought $1.64 billion in damages stemming from project delays and alleged breaches.

- CCA’s involvement was limited, with no contractual relationship to BMLP or role in the project, yet liability was assigned under a veil-piercing theory.

- The trial court ruled against the Defendants, a decision CCA intends to appeal vigorously.

- The judgment, if enforced, would require immediate liquidation of CCA’s operating subsidiaries, undermining appeal rights and causing significant operational and financial distress.

Prepetition Initiatives Leading to the Baha Mar Judgment

- Efforts to Obtain Stay and Supersedeas Bonds:

- CCA retained advisors to secure bonds and pursue a stay of judgment enforcement.

- Efforts to secure bonding through multiple providers were unsuccessful due to the scale of the judgment.

- The Appellate Division, First Department, of the New York Supreme Court (the “First Department”) denied CCA’s request for a stay, exposing the company to immediate enforcement risks.

- Contingency Planning:

- CCA’s Board, Special Committee, and advisors evaluated Chapter 11 relief to:

- Provide the Non-Debtor Subsidiaries, the Debtor’s primary assets, breathing room to pursue the appeal.

- Ensure business continuity and equitable resolution of claims.

- Position the Company for long-term viability.

- CCA’s Board, Special Committee, and advisors evaluated Chapter 11 relief to:

Chapter 11 Objectives

- The Debtor’s Chapter 11 filing aims to preserve value while pursuing an appeal of the Baha Mar Judgment. Key goals include:

- Filing an appeal brief by December 30, 2024, and seeking oral argument in March 2025.

- Addressing BMLP’s claims as a gating issue critical to the case resolution.

- Developing alternative strategies, including potential asset sales, if the appeal is unsuccessful.

- Leveraging Chapter 11 to stabilize operations, minimize disruption, and position the Company for long-term success.