Case Summary: First Mode Chapter 11

First Mode Holdings has filed for Chapter 11 following a liquidity crisis triggered by Anglo American’s termination of key agreements, with plans to sell its assets through an expedited in-court process supported by a stalking horse bid from Cummins.

Business Description

Headquartered in Seattle, WA, First Mode Holdings, Inc. (“First Mode”), along with its Debtor and non-Debtor subsidiaries (collectively, the “Company”), is focused on decarbonizing heavy industry and offers three primary products: Hybrid Electric Vehicles (HEVs), Battery Electric Vehicles (BEVs), and Fuel Cell Electric Vehicles (FCEVs).

- HEVs integrate regenerative battery packs with existing diesel vehicles to reduce fuel usage and carbon emissions by up to 25%.

- BEVs retrofit vehicles with zero-emission battery systems.

- FCEVs replace diesel engines with hydrogen fuel cells, producing zero greenhouse gas emissions.

As of the Petition Date, First Mode employed approximately 66 core employees to maintain critical know-how for its technology and potential sale.

- Prior to the reductions in force starting in 2024, the Company had approximately 228 permanent employees and 23 temporary employees, including independent contractors.

As of the Petition Date, the Company reported assets totaling $10-$50 million and liabilities totaling $50-$100 million.

Corporate History

First Mode was founded in 2018 as an engineering consultancy and transitioned to developing decarbonization products for heavy industry.

- Anglo American, a key partner, acquired a controlling 81.4% stake in January 2023, contributing intellectual property, personnel, and $200 million in cash.

The partnership with Anglo American included multi-year agreements, such as a consultancy agreement in 2019, a joint development agreement in 2021, and a Supply Agreement in 2023 for hydrogen fuel cell retrofit kits and related services.

- A strategy shift in 2023 delayed hydrogen technology development in favor of HEV solutions, which offer near-term revenue opportunities.

Anglo American’s subsequent termination of key agreements in August 2024, citing default events, precipitated First Mode’s liquidity crisis and its eventual Chapter 11 filing.

Operations Overview

The Company operates globally with a presence in the U.S., UK, Australia, Chile, and South Africa.

- U.S. operations include facilities in Washington State, with engineering and manufacturing hubs in Seattle and testing facilities at the “Proving Grounds” in Centralia.

- International offices are located in London, UK; Santiago, Chile; and Perth, Australia, with plans to vacate certain premises as part of the wind-down.

First Mode’s operations target the elimination of diesel in heavy haulage vehicles, offering tailored solutions to mining and industrial clients.

- The Company also provides consulting services to integrate its technology with client operations, addressing site-specific factors like haul road systems and access to low-carbon electricity.

The HEV became the Company’s primary focus in mid-2024, following challenges in securing hydrogen fuel cell orders.

- This strategic pivot reduced operational costs while aiming to generate near-term revenues.

Despite operational trials demonstrating the feasibility of zero-emission technologies, First Mode’s pre-revenue status and reliance on Anglo American hindered its financial sustainability.

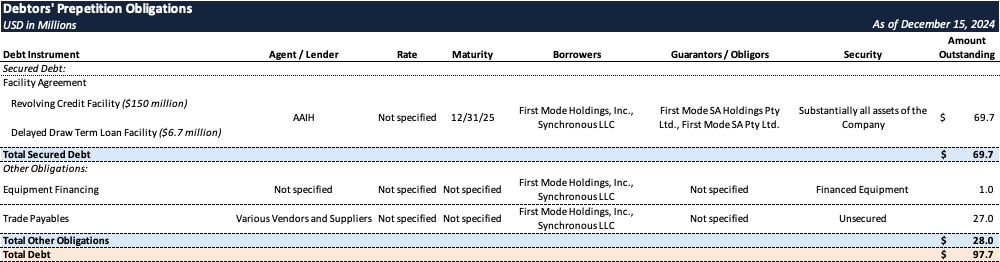

Prepetition Capital Structure

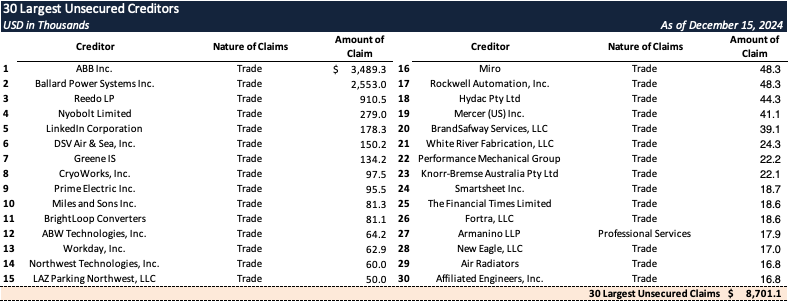

Top Unsecured Claims

Events Leading to Bankruptcy

Industry Challenges and Liquidity Crisis

- First Mode faced a capital-intensive, highly competitive market and struggled to secure additional customers beyond Anglo American.

- The delay in commercialization of hydrogen-based technologies and Anglo American’s August 2024 termination of key agreements led to immediate financial strain.

Prepetition Efforts

- The Company engaged Lazard to facilitate an $80 million capital raise but failed to finalize terms with potential investors due to Anglo American’s unwillingness to convert its debt to equity.

- Significant workforce reductions occurred in 2024, cutting 20% of U.S. staff in January, 40% of Washington State employees in August, and additional layoffs in December, as part of cost-cutting measures.

Marketing and Sale Process

- First Mode retained PJT to run a marketing process targeting strategic buyers. Of 19 contacted, 9 signed NDAs, but only Cummins submitted a binding bid.

- Negotiations pivoted to an in-court sale process, with Cummins as the stalking horse bidder.

Restructuring Support Agreement (RSA)

- On December 15, 2024, the Company executed the RSA with Anglo American, providing a $28.9 million monetary contribution and DIP financing to fund operations during the Chapter 11 process.

- The RSA outlines milestones for an expedited sale and plan confirmation, including the completion of the sale within 15 days of the court’s approval of the sale order.

Investigation and Litigation