Case Summary: Northvolt Chapter 11

Northvolt has filed for Chapter 11, citing liquidity pressures driven by scaling challenges, industry headwinds, and a failed restructuring effort, while seeking to stabilize operations and preserve its core battery production and R&D capabilities.

Business Description

Headquartered in Stockholm, Sweden, Northvolt AB (“Northvolt”), along with its Debtor and non-Debtor affiliates (collectively, the “Company”), is a battery manufacturer specializing in high-performance batteries for electric vehicles and large-scale energy storage systems.

- The Company’s operations are divided into two core categories: cells and systems.

- Northvolt offers electric vehicle battery cells, renewable energy storage, high-performance devices, and complete energy storage systems to support various infrastructure, grid stability, and temporary energy demands.

Today, Northvolt has approximately 6,600 employees across seven countries.

As of the petition date, the Debtor reported $1-$10 billion in assets and liabilities.

Corporate History

Northvolt was founded in 2016 by Peter Carlsson and Paolo Cerruti, after their departure from Tesla.

- The Company quickly gained traction after its inception, attracting over $8 billion in investments between 2017 and 2024, including support from the Swedish and other European governments.

2017:

- In January, the Company announced plans to build Europe’s largest battery cell factory, targeting 40 GWh annual production.

- By September, Northvolt secured its first major partnership with ABB Ltd.

2018:

- Early in the year, the European Investment Bank approved a loan to establish Northvolt Labs.

- Construction of Northvolt Labs began in Västerås in the spring.

2019:

- Northvolt raised $1 billion in June, backed by Goldman Sachs and Volkswagen, to develop Northvolt Ett.

2020:

- Formed the Hydrovolt joint venture with Norsk Hydro to advance battery recycling in Norway.

- Raised $1.6 billion to expand Northvolt Ett.

2021:

- In December, Northvolt Ett successfully assembled its first lithium-ion battery cell, leveraging research and development at Northvolt Labs.

2022:

- Became the first European battery manufacturer to deliver batteries to a car manufacturer.

- Announced plans for a German gigafactory, “Northvolt Drei.”

2023:

- Secured €1.3 billion in funding.

- Launched a storage systems factory.

- Expanded to North America with a $5.8 billion gigafactory in Québec, “Northvolt Six.”

Operations Overview

Locations Across Europe

Northvolt Ett (Skellefteå, Sweden):

- State-of-the-art gigafactory producing high-capacity batteries for EVs and energy storage solutions.

- Established: 2019.

- Employees: Over 3,500.

- Current capacity: 16 GWh (target: 60 GWh).

- Started supplying lithium-ion battery cells to automakers in Q2 2022.

Northvolt Labs (Västerås, Sweden):

- Hub for R&D, testing new battery cell designs, and developing manufacturing processes.

- Employees: Over 1,000.

Northvolt Dwa (Gdańsk, Poland):

- Two sites specializing in battery module and pack assembly:

- Industrial: Focused on battery module assembly; sale process ongoing.

- ESS: Dedicated to energy storage systems; currently winding down operations.

Hydrovolt (Fredrikstad, Norway):

- Joint venture with Hydro focused on recycling lithium-ion batteries from electric vehicles.

- Established: 2020.

- Capacity: Processes 12,000 tons/year (~25,000 EV batteries).

- Recovers up to 95% of materials like aluminum, copper, plastic, and black mass.

Projects Under Development

Revolt Ett (Skellefteå, Sweden):

- Battery recycling facility; partially operational.

- Designed to recover materials from end-of-life batteries for reuse in production.

- Sale process underway for Northvolt Revolt AB (including Revolt Ett).

Northvolt Drei (Heide, Germany):

- Third gigafactory project with a target output of 60 GWh/year.

- Expected to create ~3,000 jobs and strengthen Europe’s battery supply chain.

Northvolt Six (Montréal, Québec, Canada):

- Plans to become Canada’s first fully-integrated battery manufacturing plant.

- Includes cathode material production, battery assembly, and recycling.

Aurora Lithium (Setúbal, Portugal):

- Joint venture with Galp (2022).

- Aims to establish Europe’s largest sustainable lithium conversion plant.

- Planned capacity: 35,000 metric tons of lithium hydroxide/year.

- Timeline delayed due to project complexities.

Product Lines

Battery Cells:

- Lithium-ion Battery Cells.

- Sodium-ion Battery Cells (introduced November 2023; a European first).

- Lithium-Metal Cells.

Energy Solutions:

- Voltpack Core: battery solution for heavy-duty industrial applications.

- Voltpack Mobile System: mobile energy storage solution.

- Voltrack: modular energy storage system.

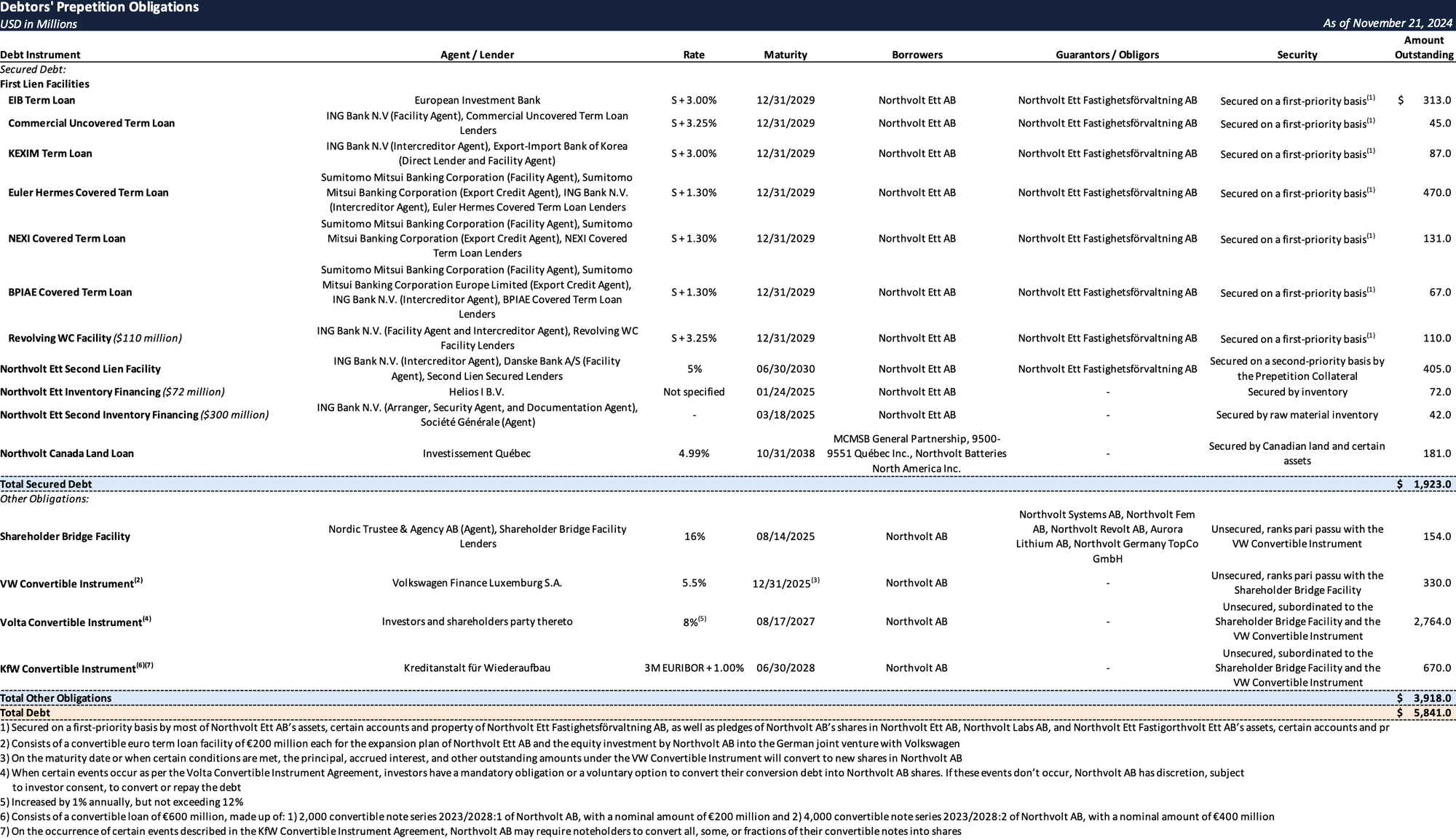

Prepetition Obligations

Northvolt Ett Hedging Arrangements

Purpose: Northvolt Ett AB is required under the Intercreditor Agreement to hedge 70%-110% of repayment obligations under the First Lien Facilities.

Counterparties: Engaged in eight interest rate contract arrangements with seven investment-grade banks (BNP Paribas, Danske Bank, ING, Intesa Sanpaolo, SEB, Société Générale, Swedbank).

Structure:

- Governed by ISDA Master Agreements with Confirmation Letters effective as of June 30, 2023.

- Pay-fixed (4.65%) / receive-variable interest swaps linked to SOFR.

- Notional amounts decline over time; all arrangements terminate by June 30, 2027.

Financials:

- Total notional value of $795 million in hedges as of the petition date.

- Mark-to-market asset value of ~$500 thousand as of October 2024.

Security:

- Obligations secured by first-priority liens pari passu with First Lien Facilities.

- Termination triggers breakage fees as per ISDA terms.

Northern Lights Commitments

Purpose: $4.5 billion debt package secured in 2023 to refinance existing facilities and fund Northvolt Ett expansion.

Agreement Structure:

- Coordinated under the Expansion Financing Co-ordination Agreement.

- Key agents include Crédit Agricole, ING, and Swedbank, with multiple related entities.

Current Status:

- Expansion project abandoned; related milestones unmet.

- EFCA Agent issued an Unwind Notice, effective November 14, 2024.

- Northern Lights Finance Arrangements terminated, except for outstanding obligations.

Outstanding Obligations: ~$44 million in accrued fees (commitment, structuring, agency fees) due within 15 business days of unwind.

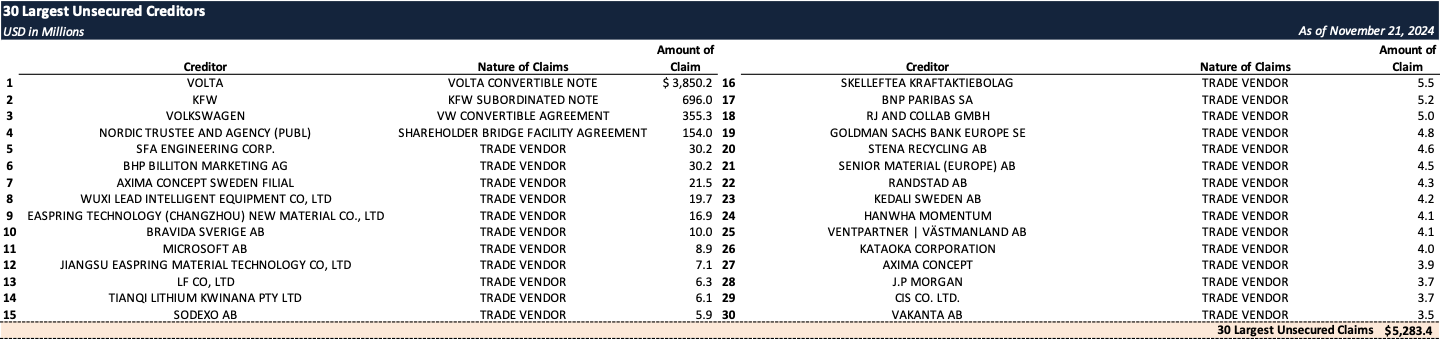

Top Unsecured Claims

Events Leading to Bankruptcy

EV Market and Industry Challenges

Declining EV Sales: EV sales growth slowed in 2023, driven by economic uncertainties and operational challenges, marking the first downturn since 2020. By 2023, EVs accounted for 18% of global passenger-vehicle sales but declined further in 2024.

Production Realignments: Manufacturers scaled back EV production to align with evolving market dynamics. European automakers followed suit, with Volvo abandoning its all-electric vehicle target and Volkswagen initiating an $11.1 billion cost-cutting plan, including factory closures and workforce reductions.

Pressure on Battery Manufacturers: The downturn heavily impacted battery manufacturers, as customers canceled contracts, reduced orders, and renegotiated terms. Furthermore, established Asian manufacturers increased production and cut prices, intensifying competition for newer entrants like Northvolt.

Challenges in Scaling and Financial Performance

Operational Struggles: Northvolt faced significant difficulties scaling up production to meet market demands. Its flagship Ett gigafactory fell behind its 2023 operational targets.

Supply Chain Vulnerabilities: Continued reliance on Chinese suppliers for critical materials and machinery left the Company exposed to supply chain disruptions.

Financial Headwinds: Northvolt’s financial losses deepened, with a net loss of $285 million in 2022 escalating to $1.2 billion in 2023, reflecting the broader industry challenges. These pressures hindered the Company’s business plan and expansion efforts.

Liquidity Crisis and Financial Interventions

Interim Financing Measures:

• In August 2024, Northvolt secured a $154 million shareholder bridge facility, providing temporary support but insufficient to offset its high operational costs.

• In late August, investor reluctance emerged, with some stakeholders unwilling to fund further unless others committed additional resources.

• In October 2024, Northvolt accessed $50 million under the “stable platform” framework, utilizing $25 million from Northvolt Ett AB’s debt service reserve account and $25 million from existing bridge funds.

Critical Liquidity Shortfall:

• Despite these efforts, Northvolt’s financial situation deteriorated rapidly. By the petition date, the Company’s liquidity position was dire, with only $30 million of available cash—enough to sustain operations for one week.

Operational Changes and Cost-Cutting Measures

To protect its core business, Northvolt streamlined operations to focus on battery technology development at Northvolt Labs and battery cell manufacturing at Northvolt Ett. Key measures include:

- June 2024: Abandoned plans to build the Northvolt Fem factory in Borlänge, Sweden, selling the land back to the local municipality.

- August 2024: Announced the shutdown of Cuberg’s R&D facility in the San Francisco Bay Area, relocating key battery R&D efforts to Västerås, Sweden; Cuberg intends to wind down remaining operations in connection with the Chapter 11 cases.

- September 2024: Discontinued the expansion of Northvolt Ett, intended to triple capacity at its gigafactory in Skellefteå; subsequently, Northvolt Ett Expansion AB filed for liquidation under the Swedish Bankruptcy Act.

- September 2024: Announced plans to eliminate 1,600 jobs, approximately a quarter of its workforce, including cuts at Northvolt Ett (1,000 jobs), Northvolt Labs (400 jobs), and corporate headquarters in Stockholm (200 jobs).

- September 2024: Ceased producing cathode materials and initiated steps to sell off its stockpile of excess battery materials.

- October 2024: Announced cessation of further capital contributions to NOVO Energy; Volvo subsequently indicated plans to exercise its share redemption right to buy out Northvolt from the joint venture, with negotiations ongoing.

- Postponed Projects: Deferred plans for other gigafactories, such as Northvolt Six in Montréal, Québec, and Northvolt Drei in Heide, Germany, though these projects remain integral to the Company’s future strategy.

- Asset Sales: Engaged in active sale processes for Northvolt Dwa Industrial, its Poland-based battery assembly business, and Revolt Ett, its battery recycling facility, intending to facilitate these sales during the Chapter 11 proceedings.

Failed Out-of-Court Restructuring Attempts

In August 2024, Northvolt engaged Teneo Financial Advisory and Rothschild & Co. as financial advisors, and Kirkland & Ellis LLP as legal counsel in September 2024, to assess strategic options.

The Company deepened engagement with shareholders, lenders, and customers regarding near-term financing to bridge to a longer-term recapitalization solution on an out-of-court basis, termed the “stable platform.”

Despite efforts, the worsening financial picture and shifting stakeholder attitudes rendered the stable platform framework unattainable.

It became evident that Northvolt would be unable to secure new financing out of court.

Preparation for Chapter 11 Filing

Northvolt shifted focus to potential in-court restructuring options.

Certain stakeholders from the stable platform negotiations—specifically Scania and the Prepetition Secured Lenders—expressed willingness to provide additional financing in a Chapter 11 process.

After arm’s-length negotiations, an agreement was reached for postpetition financing and use of cash collateral to fund the initial phase of the Chapter 11 cases.

DIP Financing: A $100 million senior-secured, superpriority, multi-draw term loan credit facility provided by Scania.

Cash Collateral Access: Releases of approximately $110 million from the Northvolt Ett debt service reserve account and approximately $35 million from other Northvolt Ett AB bank accounts.

As of the petition date, the Company’s available cash was insufficient to sustain operations beyond one week.