Case Summary: Spirit Airlines Chapter 11

Spirit Airlines has filed for Chapter 11 bankruptcy, citing inflationary pressures, operational disruptions, and failed merger attempts, as it seeks to restructure its debt and realign its business model amid a challenging market environment.

Business Description

Headquartered in Dania Beach, FL, Spirit Airlines, Inc. ("Spirit" or the "Debtor"), along with its non-Debtor affiliates (collectively, the “Company”), is a leading ultra low-cost carrier ("ULCC") that offers affordable and flexible travel options.

Spirit's ULCC business model allowed it to compete by offering customers the option to pay for only the base fare, eliminating the traditional components included in the price of an airline ticket.

- This approach enables customers to save money by choosing only the amenities they desire, such as baggage, seat assignments, priority boarding, refreshments, and Wi-Fi.

The Company, with over 21,000 direct employees and independent contractors, serves destinations across the United States, Latin America, and the Caribbean. It boasts one of the youngest and most fuel-efficient fleets in the nation.

- As of the Petition Date, Spirit employed approximately 12,800 people, including 12,300 full-time direct employees and 500 part-time direct employees.

- Notably, around 1,600 direct employees receive salaries, while the remaining 11,200 employees are paid hourly.

- Furthermore, the Company relies on approximately 8,000 individuals, including independent contractors and temporary or seasonal employees, through staffing, consulting, and other employment agencies.

- As of June 30, 2024, approximately 84% of Spirit’s Direct Employees were represented by unions.

- Spirit’s unionized Direct Employees, except for its unionized aircraft maintenance technicians, are subject to collective bargaining agreements with Spirit.

Spirit is a publicly traded corporation that commenced trading on the New York Stock Exchange in 2011 under the ticker symbol “SAVE.”

In 2023, the Company generated $5.4 billion of operating revenues.

As of the Petition Date, the Debtor reported $1-$10 billion in assets and liabilities.

Corporate History

Founded in 1964 as Clippert Trucking Company, a Michigan corporation.

- In 1990, the Company began chartering air operations and adopted the name Spirit Airlines, Inc. in 1992.

- Spirit reincorporated in Delaware in 1994 and relocated to Florida in 1999, first to Miramar and then to Dania Beach in 2024.

Spirit began operating as a ULCC nearly 20 years ago.

- In 2003, the Company expanded its operations by launching international flights, gaining valuable experience in foreign regulatory regimes and business practices.

In December 2019, the Company entered into a significant purchase agreement with Airbus S.A.S. (“Airbus”).

- The agreement involved the acquisition of 100 new Airbus A320neo family aircraft, with the option to purchase up to 50 additional aircraft.

- As of June 30, 2024, Spirit’s firm aircraft orders included 92 A320 family aircraft with Airbus, including A320neos and A321neos, expected through 2031.

- Additionally, as of June 30, 2024, Spirit secured financing for 9 Airbus aircraft scheduled for delivery through 2030 through sale leaseback transactions.

- A financing letter of agreement with Airbus provides backstop financing for remaining aircraft.

- On July 30, 2024, Spirit entered into a direct lease transaction with AerCap Holdings N.V. (“AerCap”) to lease 36 aircraft originally part of Spirit’s Airbus order book, reducing firm aircraft orders to 56 aircraft.

In 2020, in connection with a Senior Secured Notes offering, the Company transferred ownership of the Spirit brand and the Free Spirit loyalty program to newly created, wholly owned subsidiaries and entered into license agreements to use its brand and operate its loyalty program.

During Q3’21, Spirit entered into an Engine Purchase Support Agreement requiring the purchase of a certain number of spare engines to maintain a contractual ratio of spare engines to aircraft in the fleet.

- As of June 30, 2024, Spirit is committed to purchase 16 PW1100G-JM spare engines, with deliveries scheduled through 2031.

- Spirit is obligated to make pre-delivery deposit payments (“PDPs”) before each aircraft and engine delivery under its purchase agreements.

- In H1’24, Spirit paid $1.8 million in PDPs and $10.8 million in capitalized interest for future deliveries.

Operations Overview

Spirit's ULCC model revolves around achieving a low-cost structure primarily through high fleet utilization.

- The Company utilizes low fares to address underserved markets, increasing passenger volume and load factors on the flights it operates.

- Additionally, high-density seating configurations and a simplified onboard product further reduce costs.

- These strategies lead to increased sales of ancillary products and services, further reducing base fares.

The Company has developed a substantial network of domestic destinations and targeted markets in the Caribbean and Latin America, focusing on high-volume routes favored by price-sensitive travelers.

Spirit operates exclusively single-aisle Airbus aircraft, commonly known as the “A320 family” aircraft.

- This uniform fleet offers significant operational and cost advantages over airlines with multiple aircraft types.

- It eliminates the incremental costs of training crews across different aircraft types, simplifies maintenance, spare parts inventories, and operational support, and provides flexibility to match aircraft capacity and range to route demands while maintaining fleet commonality.

As of the Petition Date, Spirit’s fleet consisted of A320 family aircraft (213), including A319s (2), A320s (64), A321s (30), A321neos (26), and A320neos (91), with an average age of 5.8 years.

- The Company leases 162 aircraft and owns 51.

- Of the owned aircraft:

- 24 are financed through fixed-rate long-term debt.

- 27 are financed through enhanced equipment trust certificates.

- The Company also leases five spare engines under operating leases and owns 32 spare engines.

Spirit’s Frequent Flyer Program, known as “Free Spirit,” allows customers to accumulate points by flying on Spirit, using a Free Spirit-branded credit card, or purchasing points or shopping with the Company’s partners.

- These points can be redeemed for tickets and other goods and services from participating travel companies, hotels, car rental agencies, restaurants, and retailers.

- Most point redemptions are for Spirit tickets, which don’t result in substantial cash expenditures for the Company.

Loyalty Program (“Spirit Saver$ Club”):

- Members pay an annual fee to access:

- Discounted Spirit tickets.

- Discounted shopping and travel offers from partners.

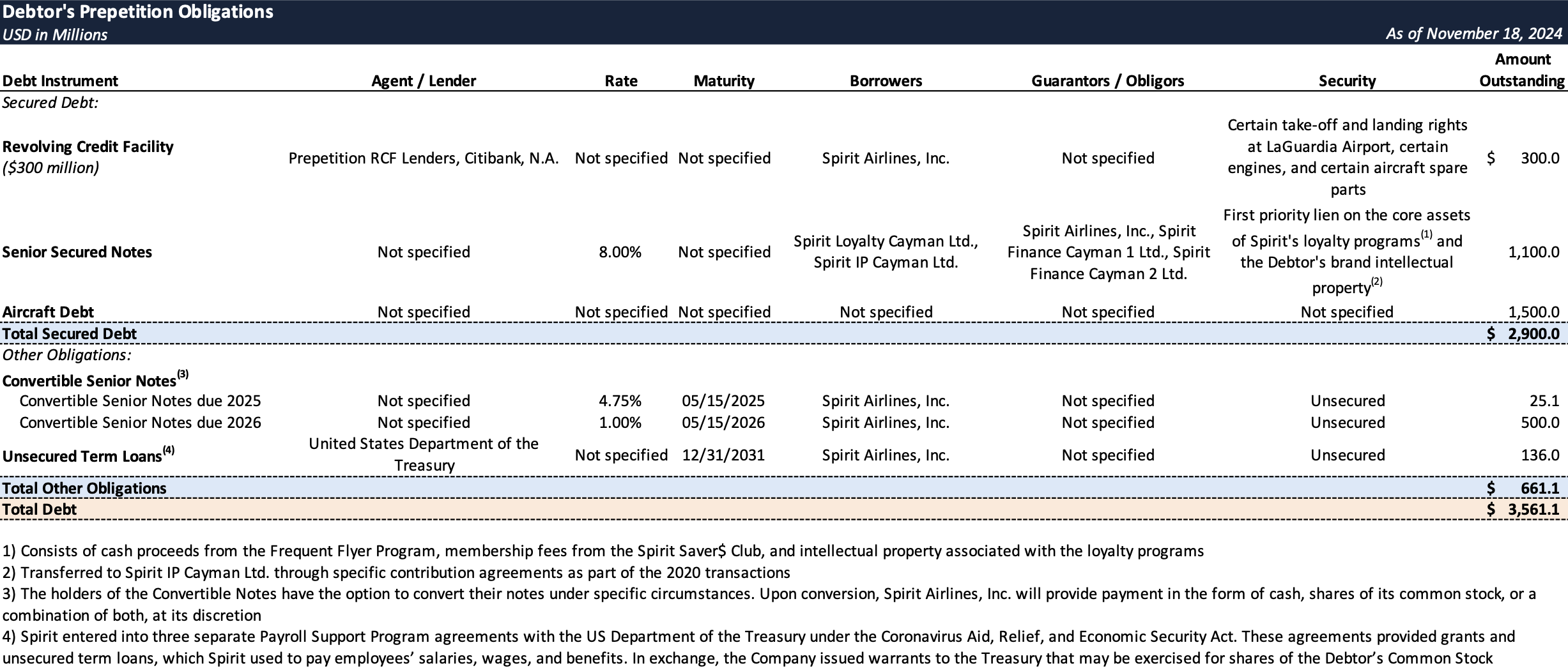

Prepetition Obligations

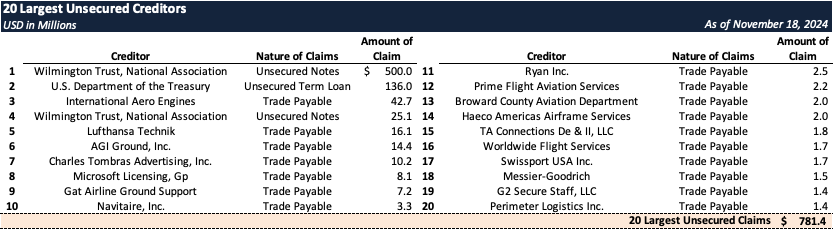

Top Unsecured Claims

Events Leading to Bankruptcy

Impact of COVID-19 and Market Dynamics

Over the past several years, Spirit, like many airlines, faced significant macroeconomic and industry-specific headwinds that strained its business and resources.

As the seventh-largest carrier in the United States, Spirit was not immune to the effects of the COVID-19 pandemic, which led to decreased air travel demand.

Business travel had not fully returned to pre-pandemic levels through 2023, and premium leisure demand soared, allowing Legacy carriers (e.g., Delta Air Lines) and Value carriers (e.g., Southwest Airlines) to compete more aggressively for basic economy share.

This shift eroded Spirit's margin advantage, as larger carriers could attract price-conscious customers while capitalizing on premium leisure demand.

Inflationary Pressures

Inflationary headwinds drove increases in unit costs for all airlines, disproportionately affecting low-fare carriers like Spirit.

Costs increased across various areas, including crew wages, fuel prices, airport fees, and other operational expenses.

These inflationary pressures impacted the needs-based travel market and compressed margins for ULCCs such as Spirit.

Failed Strategic Initiatives

Frontier Merger Agreement:

- In 2022, Spirit entered into a merger agreement with Frontier Group Holdings, Inc., the parent company of Frontier Airlines, Inc. (together, “Frontier”), aiming to create a more competitive ULCC to challenge dominant airlines.

- The merger was structured as a stock and cash transaction.

- On June 6, 2022, Spirit received an unsolicited proposal from JetBlue Airways Corporation (“JetBlue”) and engaged in discussions with both Frontier and JetBlue.

- On July 27, 2022, Spirit terminated the merger agreement with Frontier.

JetBlue Merger Agreement:

- On July 28, 2022, Spirit entered into a merger agreement with JetBlue, intending to merge with a wholly-owned JetBlue subsidiary, with Spirit continuing as the surviving entity.

- The combined company was projected to have annual revenues of approximately $11.9 billion based on 2019 figures.

- In March 2023, the U.S. Department of Justice sued to block the merger, alleging it was anticompetitive.

- On January 16, 2024, a federal judge blocked the merger, determining that it would reduce competition and give airlines more leeway to raise ticket prices.

- Following the court's decision, Spirit's stock price declined by 60%.

- On March 1, 2024, Spirit and JetBlue agreed to terminate the merger agreement, with JetBlue paying Spirit $69 million as part of the termination.

Operational Challenges

Pratt & Whitney Engine Issues:

- Equipment recalls introduced significant capacity constraints and downtime for Spirit.

- On July 25, 2023, RTX Corporation, the parent company of Pratt & Whitney, announced that certain engine parts required accelerated inspection due to issues in the powdered metal used during manufacturing.

- The affected Pratt & Whitney PW1100G-JM engines powered Spirit's A320neo family of aircraft, leading to operational disruptions.

- On March 26, 2024, Spirit entered into an agreement with International Aero Engines, LLC (an affiliate of Pratt & Whitney), wherein Spirit would receive monthly credits through the end of 2024 for each aircraft unavailable due to engine issues from October 1, 2023.

- On April 3, 2024, Spirit amended a purchase agreement with Airbus to defer all aircraft deliveries scheduled from the second quarter of 2025 through the end of 2026 to 2030–2031.

- Pratt & Whitney agreed to issue Spirit $30.6 million in credits related to aircraft downtime during the first three months of 2024, with negotiated credits expected to range from $150–200 million in 2024.

Strategic Initiatives

Project Bravo:

- In response to shifting market dynamics, Spirit embarked on a comprehensive strategic transformation known as "Project Bravo" to improve its financial profile and realign its business model.

- On July 30, 2024, Spirit unveiled new premium offerings aimed at delivering a friendlier, more comfortable, and more cost-effective travel experience.

- The new travel options included Go Big, Go Comfy, Go Savvy, and Go, providing a range of amenities such as free Wi-Fi, cabin baggage, snacks, and drinks, all with the flexibility of no change or cancel fees.

Aircraft Transactions:

- On January 3, 2024, Spirit completed a series of sale-leaseback transactions involving 25 aircraft, resulting in the repayment of approximately $465 million of indebtedness and net cash proceeds of approximately $419 million.

- On October 29, 2024, Spirit entered into an aircraft sale and purchase agreement with GA Telesis, LLC, agreeing to sell 23 Airbus A320ceo/A321ceo aircraft for an expected total purchase price of approximately $519 million.

- Some aircraft were delivered to GA Telesis prior to the bankruptcy filing, with the remaining scheduled for delivery in the coming weeks.

Financial Constraints

Elavon Agreement Amendments:

- On May 21, 2009, Spirit entered into a credit card processing agreement with Elavon, an affiliate of U.S. Bank National Association.

- On July 2, 2024, the agreement was amended to extend its term and required Spirit to deposit $200 million into a U.S. Bank deposit account and $50 million into a restricted U.S. Bank account.

- The $200 million was considered a compensating balance arrangement without legally restricting Spirit's use of the cash.

- Subsequent amendments in September and October 2024 extended deadlines related to refinancing certain senior secured notes and adjusted the expiration date under the agreement.

Advisor Engagement and Restructuring Efforts

Engagement of Financial Advisors:

- In the spring of 2024, facing approaching debt maturities and after the termination of the JetBlue merger, Spirit engaged Perella Weinberg Partners as investment banker and Davis Polk & Wardwell LLP as legal counsel.

- Alvarez & Marsal North America, LLC was engaged as financial advisor to assist with restructuring efforts and to facilitate the commencement of Chapter 11 proceedings.

- Spirit and its advisors explored strategic alternatives, including restructuring its senior secured notes and convertible notes, and evaluated various transactions to right-size its assets and capital structure.

- Despite efforts, viable out-of-court restructuring options became increasingly unlikely.

Entry Into the Restructuring Support Agreement

Negotiations with Stakeholders:

- Over several months, Spirit engaged in extensive good-faith negotiations with key stakeholders, including members of the ad hoc groups of senior secured noteholders (holding approximately 72.6% of the senior secured notes) and convertible noteholders (holding approximately 81.3% of the 2025 convertible notes and 84.3% of the 2026 convertible notes).

- These stakeholders were provided access to confidential information regarding Spirit's operations, financial projections, and potential liabilities.

- Multiple restructuring proposals were exchanged and considered during the negotiations.

- Discussions with Frontier regarding a possible merger were restarted but eventually discontinued.

- On November 18, 2024, Spirit executed a Restructuring Support Agreement (RSA) with the consenting stakeholders, agreeing to support the consummation of a "prearranged" Chapter 11 plan.