Case Summary: Zurvita Chapter 11

Zurvita Holdings, Inc. filed for Chapter 11 to address financial and operational challenges through a strategic sale process.

Business Description

Headquarted in Irving, TX, Zurvita Holdings, Inc. (“Zurvita”), along with its Debtor and non-Debtor subsidiaries (collectively, the “Company”), is a global marketer of health and wellness products.

Utilizing a direct sales model powered by network marketing, the Company offers a range of nutritional and dietary supplements and functional food products under the Zurvita brand (“Zurvita Products”), including:

- Zeal: A low-calorie, all-in-one nutrition drink.

- Zurge™: An instant coffee designed to enhance memory and cognitive health.

- Zundora™: An antioxidant collagen-boosting hydrolyzed gel.

In addition to its flagship products, the Company market a broader portfolio across categories such as nutrition and supplements, performance and fitness, and wellness and merchandise.

As of the Petition Date, the Company reported assets totaling $1-$10 million and liabilities totaling $10-$50 million.

Corporate History

Zurvita, Inc. was initially founded as a wholly owned subsidiary of The Amacore Group, Inc. in 2008.

In 2009, Red Sun Mining, Inc., a shell company founded in 2007, acquired Zurvita, Inc. through a Share Exchange Agreement, creating the combined entity now known as Zurvita Holdings, Inc.

- Key structural changes included the appointment of new leadership, the resignation of Red Sun’s original officers, and the transfer of ownership to Zurvita, Inc.’s former shareholders.

Initially, Zurvita marketed a variety of products, including life insurance and utilities. In 2010, recognizing growing consumer interest in health and wellness, the Company pivoted toward this market, culminating in the 2011 launch of “Zeal.”

- Following Zeal’s success, Zurvita streamlined its operations to focus on the health and wellness industry.

Operations Overview

Zurvita employs a direct sales approach driven by over 20,000 independent business owners (“Field Consultants”) who form the backbone of its sales and marketing strategy.

- Field Consultants are independent contractors earning commissions and bonuses by selling Zurvita Products and recruiting others to the business.

- Marketing strategies include referrals, video promotions, conferences, social media, and word-of-mouth.

A proprietary technological platform supports Field Consultants by enabling the creation of personalized websites, offering tools such as:

- Detailed sales and performance metrics.

- Informational content on Zurvita Products and the business model.

- Comprehensive training resources.

The Company also handles customer service in-house through a bilingual call center that provides full-service inbound and outbound support.

- Zurvita regularly communicates with both Customers and Field Consultants via email campaigns and a weekly newsletter featuring updates on campaigns, discounts, and business developments.

Corporate Structure and Subsidiaries

Zurvita Holdings is the primary operating entity, managing the Company’s workforce and Consultant compensation.

- A non-debtor subsidiary, Zurvita Mexico, facilitates product distribution within Mexico, an important sales market.

- Other non-debtor entities, such as Z-Blends, LLC and Intermediate Lease Holdco LLC, are inactive and expected to be formally dissolved.

Manufacturing and Supply Chain

Zurvita collaborates with third-party U.S.-based vendors to manufacture its inventory. Key partnerships include:

- Progressive Laboratories for Zeal and other core products.

- Gemini Pharmaceuticals for products such as Zeal Burn and Cleanse.

- PreMark Health Science and Uniwell Laboratories for Zeal Protein and Zundora™.

The Company maintains strong vendor relationships and oversees compliance and quality control internally, aided by its Scientific Advisory Board.

- This board comprises industry experts who contribute to product validation, regulatory compliance, and R&D efforts.

Products are distributed through a single warehouse in Irving, Texas, in collaboration with third-party logistics providers.

Sales Model

The network marketing structure not only generates revenue but also incentivizes Field Consultants to expand their networks, creating a scalable and sustainable sales force.

- Consultants’ ability to build personal brands and websites enhances their role as affiliate marketers and strengthens their connection to the Zurvita brand.

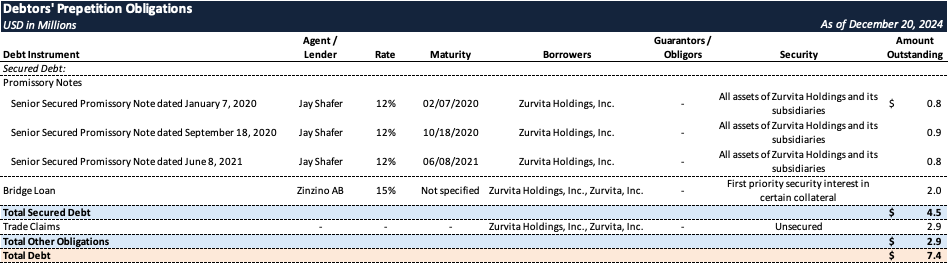

Prepetition Capital Structure

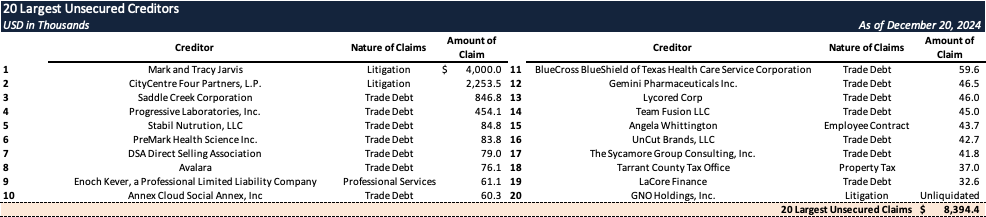

Top Unsecured Claims

Events Leading to Bankruptcy

Misaligned Incentives and Negative Cash Flow

Despite experiencing revenue growth from 2019 through 2021 due to success with Zurvita Products, much of this growth was driven by a faulty compensation plan that resulted in negative cash flow, despite strong top-line performance.

- Misaligned incentives between the Company and its Field Consultants further exacerbated liquidity issues, leading to ongoing financial strain.

- Although some steps have been taken to address the misalignment, the Company continues to operate with negative cash flow.

Licensing Disputes and Breach of Agreements

In 2019, Mark Jarvis, a former co-CEO, sought to start a business venture in Asia leveraging loyalty to the Zurvita brand.

- Following negotiations, the Board licensed Zeal for Life to GNO Holdings, Inc. (“GNO”), an entity owned by Terry LaCore, for exclusive sale in Asia. In exchange, Zurvita would receive a 1% commission on sales, and Zurvita retained 25% ownership in GNO.

- The agreement stipulated that GNO would not compete in markets where Zurvita operated (United States, Canada, and Mexico).

However, GNO violated the agreement by selling rebranded Zeal for Life products in the United States. Concurrently, Jarvis allegedly harmed the Company’s reputation and recruited Field Consultants.

- The Company initiated multiple litigations against GNO, Jarvis, and other entities, citing breach of contract, fiduciary duty violations, misappropriation of trade secrets, and trademark infringement.

Industry Competition and Litigation Impact

The competitive business-to-business landscape, combined with the aforementioned disputes, placed additional strain on the Company’s operations.

- Significant time and resources were allocated to litigation, further depleting the Company’s financial reserves.

- The Field, critical to the Company’s operations, was destabilized, resulting in reduced sales and heightened operational challenges.

Revenue Purchase Agreements and Liquidity Crisis

To address liquidity needs, the Company entered into multiple Revenue Purchase Agreements that carried above-market interest rates.

- These agreements resulted in over $100,000 being debited weekly from the Company’s accounts, severely constraining operational cash flow.

Strategic Alternatives and Marketing Efforts

After the COVID-19 pandemic, the Board explored strategic options to address liquidity challenges, including a potential sale of assets.

- In late 2023, the Company conducted an informal marketing process targeting the direct selling industry to identify equity investors or buyers, resulting in two signed Letters of Intent (LOIs).

- In June 2024, the Board pursued an LOI with Zinzino for an out-of-court merger. However, the LOI expired without a transaction being completed, leaving the Company with limited alternatives.

Decision to Pursue Chapter 11 Sale Process

Following the expiration of the Zinzino LOI and worsening liquidity, the Company decided that a Chapter 11 bankruptcy sale process would maximize asset value for creditors and stakeholders.

- The Restructuring Committee negotiated and executed a Restructuring Support Agreement (RSA), which includes:

- A sale term sheet providing for the sale of substantially all assets to Zinzino via a credit bid and assumption of liabilities.

- Approval for expense reimbursement up to $250,000 if Zinzino is not the successful bidder.

Postpetition Financing and Expedited Sale Process

The RSA incorporates a DIP Facility Term Sheet for a senior secured debtor-in-possession loan totaling $4.44 million, with a 15% payable-in-kind interest rate.

- No alternative financing proposals were received by the Debtors.

The proposed expedited sale process aims to minimize administrative costs and maximize asset value while mitigating operational disruptions for vendors, Consultants, and employees.

- Prepetition marketing efforts provide a strong foundation for achieving the highest and best value in a compressed timeline, benefiting all stakeholders.